(AEN) – Without a question, PayPal is among the greatest payment options available in the modern world. What if, though, you are unable to use this facility?

Well, that is regrettably accurate in the case of Pakistan. The payment company PayPal has declined to enter the Pakistani market, despite repeated attempts by the Pakistani government to introduce the service domestically.

In the world’s freelance market, Pakistani individuals currently hold the 4th position. Numerous options have been made available to Pakistani freelancers as a result of the expanding potential of digital businesses.

Selecting a secure payment method is challenging due to the rising fraud risks and security vulnerabilities in digital payment solutions. Therefore, freelancers need to exercise caution while selecting a payment option. When making a decision of this nature, safety precautions must be taken.

Many of these make sense alternatives for PayPal. For freelancers, these payment methods provide a variety of online transaction possibilities that are practical.

We’ll talk about PayPal Alternatives for Freelancers in Pakistan.

Top 10 PayPal Alternatives for Freelancers in Pakistan

In Pakistan, there are several Paypal alternatives for freelancers which are as follows:

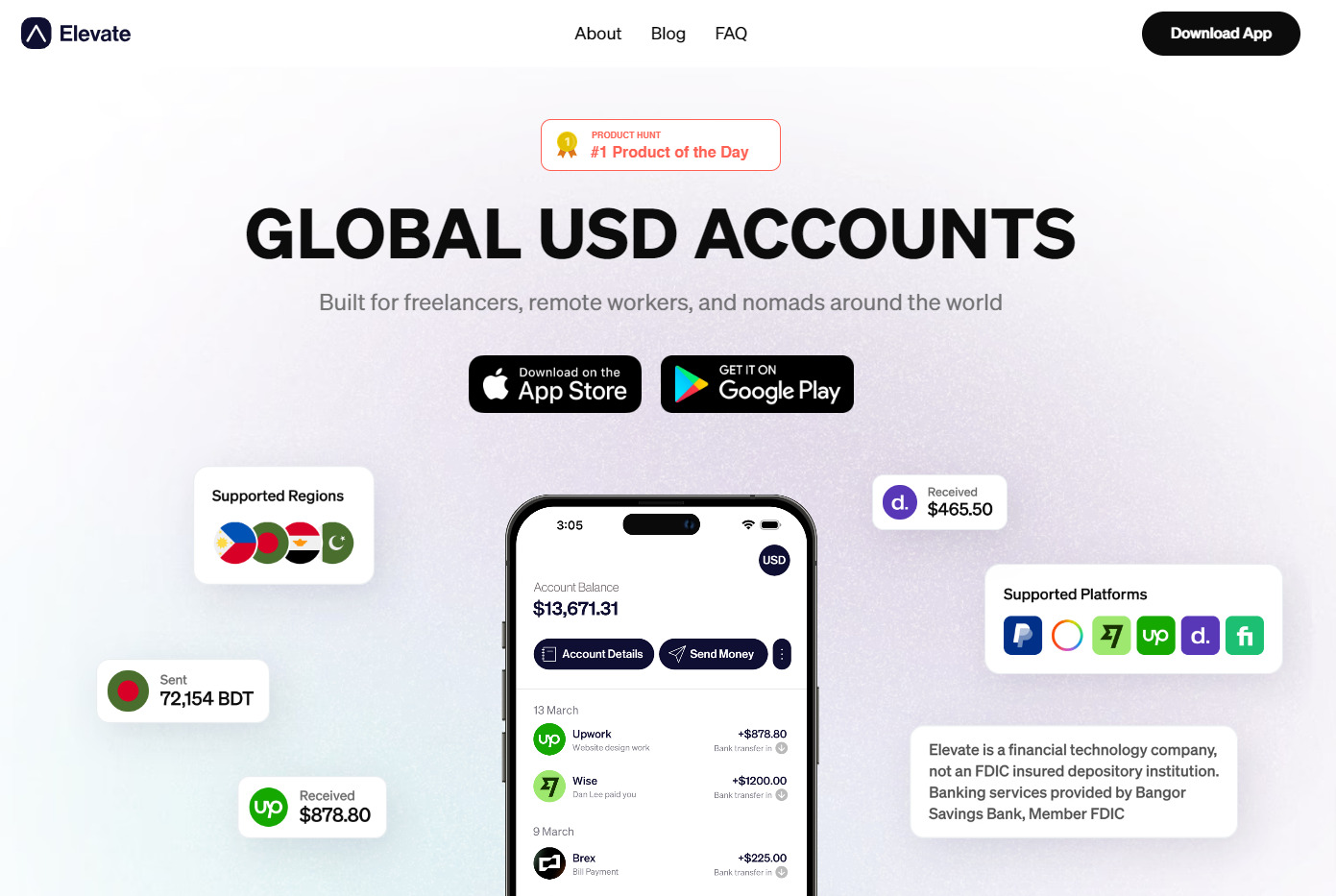

1. Elevate Pay

Elevate Pay is a fairly new fintech company whose goal is to make it easier to send money to other countries. It costs less for Pakistani freelancers and people who work from home. What it is and how you can use it are broken down below:

Elevate Pay: What Is It?

- A startup backed by Y Combinator that gives independent workers in Pakistan FDIC-insured US bank accounts.

- Attempts to make it easier to receive payments from other countries without needing complicated or expensive steps.

How to use Elevate Pay to send money to other countries in Pakistan:

- Register: Create an account by visiting elevatepay.co and filling out the online form. The process is pretty simple and only needs some basic details.

- Verification: Finish the verification procedure, which calls for presenting a few identity papers.

- Open a bank account in the US: After being checked out, you’ll get a US bank account with routing and account numbers.

- How to Get Payments: Customers or sites that need to send you USD from outside of the US should have access to your account information.

- Get to the Funds: You can use local transfers to get money into your Pakistani bank account, or you can use the Elevate debit card to make payments anywhere in the world.

Why using Elevate Pay is a good idea:

- No fees for transactions: Within the Elevate ecosystem, there are no fees to receive or give money.

- Fair exchange rates: Find out the precise exchange rates before exchanging any currencies.

- Free bank account in the US: Avoid opening expensive overseas accounts.

- Totally free debit card: Pay for things online and in stores around the world.

- Free of hassle: Make it easier to send money internationally than it was in the past.

2. Payoneer:

Payoneer is a popular way to send money to people in other countries, and it gives workers a fake U.S. bank account. Clients can give money to the freelancer’s Payoneer account, and the money can be taken out at any bank in Pakistan.

It also gives workers a paid-ahead-of-time MasterCard that they can use to make purchases online and off, as well as withdraw cash from ATMs.

- Available in over 150 countries

- It works for all freelance sites: There’s Freelancer, Upwork, Fiverr, and PeoplePerHour.

- Several monetary kinds are within your purview: There is US cash, GBP cash, and Euro cash.

- By entering the clients’ names, email addresses, countries, and states on Payoneer, you can send invoices to individual customers.

- By giving the following information—the company name, website, contact name, email address, and country—you can forward the invoice to the business’s Payoneer account.

- Your First Century Bank US and Barclays UK bank accounts will be set up as receiving accounts by Payoneer.

- Transfers between Payoneer accounts are always free.

- Low fees and the most secure withdrawal method

- All banks in Pakistan accept it.

3. Local Bank Payments:

Freelancers can give their clients in other countries the information for their local bank account so they can receive direct payments.

There may be extra fees for currency conversion and international wire transfers with this way, though. It’s important to find out from your bank what their rules are and how much they charge for foreign transactions.

- Both Upwork and PeoplePerHour provide such possibilities.

- It is not recommended due to transaction costs.

4. TransferWise:

TransferWise, which is now called Wise, is an easy-to-use tool for sending money to other countries. You will receive a payment even if you do not have a Wise account. Clients are the only ones who can log in to wise.com and give their information during the setting process.

When you get paid through Wise, the money can go straight into your local bank account. This is useful for users all over the world, but it’s especially helpful for people in the UK.

The following information should be provided first:

- Name (First Name and Last Name)

- Father Name

- CNIC (National Identification Card Number)

- IBAN (International Bank Account Number)

- Phone Number

- Email Address

- Date of Birth

- Country

- City

- Postal Code

- Region

If you are in Pakistan, you may also create a Wise account and utilise it in the same manner as Payoneer. If you sign up for Wise right now, you can send up to 500 GBP without any fees.

5. Skrill:

Skrill is an online wallet perfect for people and companies that need to easily move and manage their money.

Please keep in mind that Skrill is mainly an online payment service that lets people all over the world send and receive money. People and businesses can easily and safely handle their money transactions on this site. You can sign up online.

On the other hand, you can keep Pakistani Rupees in your Skrill account. Any money you add to your Skrill wallet has to be changed into one of the world currencies they accept.

6. Xoom.com (PayPal Service):

Xoom.com is a service offered by PayPal that makes it easy to send money to other countries.

It’s not necessary to have a Xoom account in order to get paid. Clients are the only ones who need to use their PayPal account to log in to xoom.com and fill out their information for the first time.

It’s especially good for customers in the US, UK, and Canada. Freelancers can use foreign payment methods

You can easily get your money when you receive payments through Xoom.com because the money can be sent straight to your local bank account.

Here’s what you need to give to begin:

- Name (First Name and Last Name)

- Father Name

- CNIC (National Identification Card Number)

- IBAN (International Bank Account Number)

- Phone Number

- Email Address

- Date of Birth

- Country

- City

- Postal Code

- Region

You can easily get paid through Xoom.com and have the money sent to your local bank account by giving these information.

7. Western Union:

Western Union is a reliable service that lets you send and receive money all over the world. You will need to give Western Union the following information in order to get paid:

- Your Name (First Name and Last Name)

- Your Location

You will get a Money Transfer Control Number (MTCN) from the client when the sender starts the job.

To get the money, you should go to a Western Union branch near you and show the following papers:

- Copy of your CNIC (National Identification Card)

- MTCN received from the client

- Your phone number

If you bring these papers to your local Western Union branch, you can easily get the money.

8. SadaPay:

SadaPay makes it easy and cheap for freelancers and people in Pakistan to get paid internationally. To set up your account and start getting money, do the following:

What’s needed:

- National Identity Card (NIC): To verify your account, you’ll need to show your NIC.

- Active mobile number: This is how you’ll log in to your account and get alerts about transactions.

- Smartphone: You can get the SadaPay app from Google Play or the App Store.

Steps:

- Get the app and install it: In your app store, look for “SadaPay” and get the app.

- Sign up: To create your SadaPay account, open the app and adhere to the on-screen directions. Next, create a strong password by entering your phone number and confirming it with the OTP.

- Full KYC Verification: In order to verify your identification, provide your NIC details and snap a selfie.

- Upgrade to SadaBiz: Choose “Upgrade to SadaBiz” under the “Settings” page when your account has been validated. This type of account is meant to receive payments from other countries with better exchange rates and lower fees.

- Obtain your Virtual IBAN: You will be issued a distinct virtual IBAN (International Bank Account Number) when upgrading to SadaBiz. Give your clients this IBAN so they can make international transfers.

- Get Paid: Your customers can use your virtual IBAN to give you international money. The money will be sent straight to your SadaPay account in PKR.

- Access your Funds: You can make transactions anywhere Mastercard is accepted or take cash out of ATMs using your SadaPay Mastercard debit card. For additional transactions, you can easily move money to your local bank account.

Extra Advantages:

- Transparent fees: SadaPay is less expensive than traditional banks because it just charges a flat fee of Rs. 70 plus tax for foreign transactions.

- Competitive exchange rates: When you change your foreign cash to PKR, get rates that are competitive.

- 24/7 customer service: SadaPay’s website and app offer24/7 customer service.

Things to remember:

- SadaBiz accounts can only receive up to Rs. 400,000 in foreign payments every month.

- When your customers give you money, make sure they use the right IBAN format.

9. Jazzcash:

JazzCash is still a popular way for people in Pakistan to receive foreign payments, even though it’s not as flexible as SadaPay for freelance work. It may have higher fees and less customised features than SadaPay, but its large network and ease of use make it suitable for a wide range of needs.

Here’s how to use JazzCash to get money sent to you from other countries:

Requirements:

- You can use your Warid or Jazz mobile number as your JazzCash account number directly.

- CNIC: Needed to verify account and make some transfers.

- Smartphone with the JazzCash app (not required): Makes accessing and managing transactions easy.

Steps:

- Activate your JazzCash account: To do this, if you haven’t already, go to a JazzCash dealer or call *786# from your phone. Give your CNIC and do what it says on the screen.

2. Select how you want to receive:

-

- Foreign money transfer services: You can pick up cash with MoneyGram, Western Union, and other affiliated services. Use the JazzCash app or website to find the location of the closest agent.

- Direct bank transfer: Tell the person your JazzCash account number, which starts with “03.” But the fees and exchange rates might not be as good.

3. Acquire and Utilise Funds:

-

- To retrieve your funds in PKR during a cash pickup, provide the agent the transaction reference number you were given.

- For direct bank transfers, the money will be sent to your JazzCash account immediately. You can get cash from JazzCash operators and ATMs, or you

- can use the JazzCash app to pay for things online and add money to your phone.

Things to remember:

- Fees are higher: Compared to SadaBiz, JazzCash charges more for international purchases.

- Not many ways to pay online: Mostly focused on local businesses and cash transactions.

- A complicated system of fees: Fees change based on the type of transaction, the amount, and the service provider.

10. Cryptocurrency

Here is a guide on how to use cryptocurrency to receive foreign payments in Pakistan:

Requirements:

- Wallet for cryptocurrencies: Select a trustworthy, safe wallet to hold your favourite cryptocurrency (such as Bitcoin, Ethereum, etc.).

- Some popular choices are:

- Exodus, Trust Wallet, and Electrum are non-custodial apps for Bitcoin.

- Binance, Coinbase, and Kraken all offer custody wallets.

- Some popular choices are:

- Cryptocurrency exchange account (not required): Pick a reputable exchange that works in Pakistan, like Binance, LocalBitcoins, or Paxful, if you need to change cryptocurrency to Pakistani Rupees (PKR).

Steps:

- Provide the address of your wallet:

- Give the sender your unique wallet address to get paid. Since transactions are final, make sure they are accurate.

- Acquire the cryptocurrency:

- The transfer is started by the sender from their exchange or wallet. Depending on how busy the network is, funds normally get sent within minutes.

- Optional: Change to PKR:

-

- Transfer your coin from your wallet to an exchange where you can withdraw PKR if necessary.

- Exchange your coin for PKR, then transfer the funds to a bank account in your nation of origin.

Why using cryptocurrency is a good idea:

- Fast and cross-border: Transfers are often cheaper and faster than other ways to send money internationally.

- No middlemen Get rid of banks and other financial companies to cut down on fees and the chance of censorship.

- Privacy and control: You can stay anonymous and still have full power over your money.

- Global market accessibility: Take part in the growing cryptocurrency market and you might get your money back.

Factors to Consider and Advice:

Transaction Fees: It is imperative to assess the transaction fees associated with each international payment method. Fees for obtaining, converting, or withdrawing funds may be imposed by certain platforms, which can have an impact on overall earnings.

Exchange Rates: Particularly when converting funds from foreign currencies to Pakistani Rupees, it is crucial to monitor exchange rates. It is advisable to compare rates from various sources to guarantee that you receive the most value for your money.

Legal and Regulatory Compliance: Acquaint yourself with the legal and regulatory requirements that are associated with the receipt of international payments in Pakistan. Stay informed about any modifications to policies that may impact your payment methods.

Consultation: Seek guidance from financial advisors or fellow freelancers who have experience with international payments. Their experiences and insights can offer valuable advice in selecting the most appropriate payment method.

Conclusion:

The prevalence of freelancing in Pakistan has surged; however, the limited financial options and money regulations present challenges in the process of obtaining international payments. Freelancers can overcome these challenges by utilising platforms such as Skrill, Payoneer, TransferWise, Xoom.com, and Western Union to securely process international payments.

JazzCash, EasyPaisa, UBL Omni, NayaPay, SadaPay, SadaBiz, and Raast are among the mobile payment services and bank transfers that provide convenient solutions for local transactions. It is imperative to consider exchange rates, exchange charges, and legal compliance.

Seeking advice from seasoned freelancers or financial advisors can guide freelancers towards the most suitable payment method for their needs, thereby ensuring financial success in their freelance careers.

RELATED POSTS: